Calculate Your Consulting Rate: The 3-Step Formula

Your weekly edge for turning expertise into income

Quick Hits

📌 This week: How to calculate your consulting hourly rate using a CFO-approved 3-step formula that protects your downside.

💡 The insight: Most new consultants undercharge by 30-40% because they divide their old salary by 2,080 hours instead of accounting for realistic billable time and true business costs

⚡ Your move: Calculate your baseline rate this week—it's the minimum you can charge without subsidizing clients with your retirement savings.

🎧 Listen online: The Old Math Trap

Coffee with Curt ☕

Keep Building

I finally hit publish on my YouTube welcome video this week. The result? Not great. My delivery was stiff, the lighting could be better, and I stumbled over words more than I'd like to admit.

But here's the thing: it's done. I'm using Descript to learn video editing and TubeBuddy to figure out how YouTube actually works. The learning curve is steep, and recording myself was harder than I expected. But I shipped it anyway because version one beats version zero every time.

Now I have a baseline of how bad a video can be 😂 I just need to improve 1% with each new one!

Video of the week: My first-ever YouTube video introducing Retirepreneur and why your second act might be your best act yet.

WATCH: Curt's YouTube Welcome Video

Just as I'm navigating the learning curve of video production, many of you are navigating the math of pricing your expertise. So let's tackle the single biggest financial mistake new consultants make.

How to Calculate Your Consulting Hourly Rate in 3 Steps

You send the proposal. They accept. Then panic sets in. Did you charge enough to cover your time, expenses, and the value you're delivering?

Many new consultants undercharge significantly because they're guessing, not calculating. Your expertise has real value, but only if you price it correctly from day one.

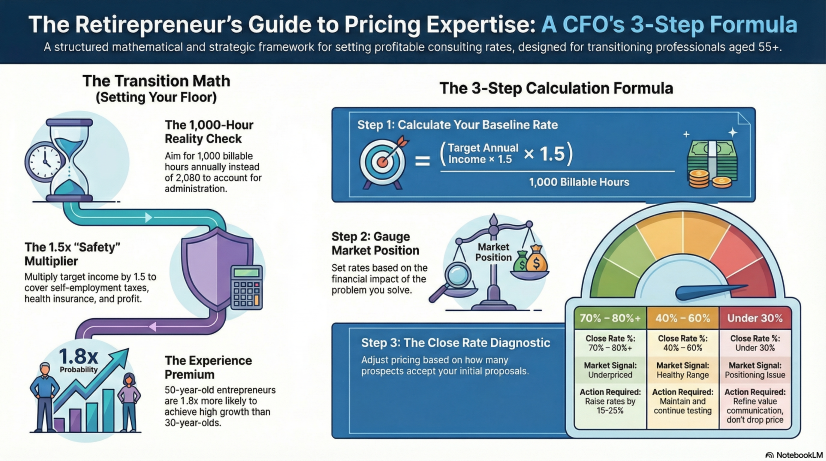

🔸Step 1: Start With Your Baseline Number

Calculate what you need to earn per billable hour just to break even. Take your target annual income and divide by 1,000 billable hours, not 2,000. You won't bill 40 hours weekly when you factor in business development, admin work, and the reality of consulting life.

Then add at least 30% for business expenses, taxes, and benefits you're now covering yourself. Better yet, add 50% to include a modest profit margin. This is your floor, not your rate.

Consider: if you made $120K as an employee, your consulting baseline calculation looks like this: ($120K × 1.5) ÷ 1,000 hours = $180/hour minimum. That's the math protecting your downside.

🔸Step 2: Layer In Your Market Position

Step 1 gives you your walk-away price, the absolute minimum you can accept. Step 2 determines what the market will actually bear. Your final rate lives in the tension between these two numbers.

Your rate reflects expertise level, industry demand, and problem complexity, not just time spent. This is where your decades of experience become your competitive advantage.

→ Check agency rate cards and boutique firm websites in your niche

→ Research peers in your specific vertical (skip general freelancer marketplaces—they anchor prices low)

→ Consider: Are you solving $10K problems or $100K problems?

A consultant solving cash flow crises might command $250-400/hour. Someone handling bookkeeping might charge $75-125/hour. Same financial expertise, different problem scale.

🔸Step 3: Test and Adjust

Your first rate is a hypothesis, not a lifetime commitment. Start with your calculated rate for the first 3-5 clients. If you're booking most qualified conversations (70-80%+), you're likely underpriced. If you're booking under 30%, reassess how you're framing value before dropping your rate.

Pricing clarity comes from market feedback, not endless research.

Your consulting rate isn't arbitrary. It's math plus market positioning plus testing.

🔹The calculation protects your downside.

🔹The market research positions you correctly.

🔹The testing proves what works.

Next Steps

⚡ YOUR FOCUSED ACTION THIS WEEK

→ Run your baseline calculation and write down that number. Put it somewhere visible. That's your walk-away price, the rate below which every hour you work is coming directly out of your retirement account. Knowing this number changes every pricing conversation you'll ever have.

Want to go deeper?

📖 How to Calculate Your Consulting Hourly Rate After Retirement: A CFO's 3-Step Formula: Get the complete 2,500-word guide with detailed examples, market research strategies, and special considerations for 55+ consultants including Social Security earnings tests and S-Corp tax strategies. → Read the full article

🎯 Retirepreneur Hub: Access business templates, pricing guides, and startup checklists designed for 55+ entrepreneurs - completely free, no credit card required. → Join Free

🏠 Keep building,

—Curt

Know someone who needs this? Forward this →