Legal & Tax Basics for Your Retirement Business: What Every Retiree Entrepreneur Needs to Know

May 07, 2025

Why Legal and Tax Planning Matters for Retiree Entrepreneurs

Starting a business in retirement isn't just about passion—it’s also about protecting what you’ve built.

Legal and tax planning may not be the most exciting part of launching your second act, but it’s one of the most important. The decisions you make now—about business structure, taxes, and registration—can either make your life easier… or lead to unnecessary stress down the road.

Retirees face unique overlaps between personal finances, Social Security, Medicare, and part-time income. The right business setup can help you:

- Preserve your retirement benefits

- Reduce unnecessary taxes

- Protect your assets

- Leave a clean legacy for your family

This guide isn’t about legal jargon or IRS anxiety. It’s about simplicity and clarity so you can move forward confidently and with peace of mind.

We’ll cover the basics of legal structure, tax considerations, and a few key steps to help your business establish a solid footing without becoming overwhelmed.

You’ve already managed major life decisions. This is just the next smart step in doing business your way.

👉 How to start a business after retirement

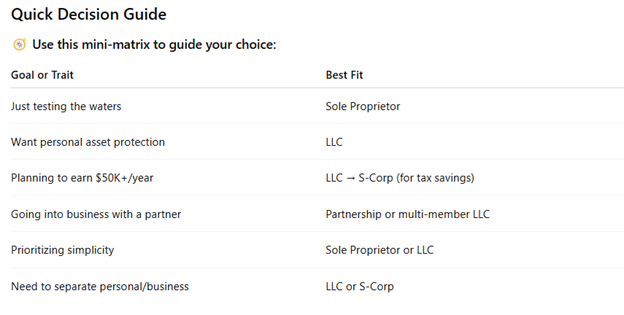

Choosing the Right Legal Structure for Your Retirement Business

Before you earn your first dollar, you’ll want to decide how your business will be legally structured. This choice affects how you're taxed, what kind of paperwork you’ll need to file, and—importantly—how protected your assets will be.

The good news? Most retirepreneurs can choose a simple structure that balances ease, protection, and cost.

Common Options and What They Mean

Here are the most common business structures retirees use—and what they mean in real-world terms:

- Sole Proprietor

- You and the business are legally the same. Easiest to start, but no personal liability protection. Ideal for low-risk, solo work.

- LLC (Limited Liability Company)

- A flexible, low-maintenance option that protects your assets. Popular with solo entrepreneurs and small partnerships.

- S-Corporation (S-Corp)

- A tax election (not a separate entity type) that can reduce self-employment taxes once you’re earning consistently. Requires more paperwork and payroll setup.

- Partnership

- Shared ownership between two or more people (often couples). You’ll need a simple partnership agreement and must file a separate tax return.

Pros and Cons for Retirees

What matters most? Balance.

- Simplicity vs. Protection

- Sole proprietorships are easiest, but provide no personal protection. LLCs add peace of mind without major red tape.

- Tax Treatment

- LLCs and sole proprietors report income on your personal return. S-Corps can save money once your profit exceeds $40K–$50K/year, but it requires payroll and bookkeeping.

- Administrative Burden

- If you want simple, stick with sole proprietor or LLC. S-Corp may be worth it if you're building something bigger or more profitable.

- Flexibility

- Starting as a sole proprietor or LLC lets you pivot easily. You can always change later as your business grows.

💬 Pro Tip: Many retirees start as sole proprietors and upgrade to an LLC once they feel the business is real and recurring.

Business Registration, Licenses, and Permits

Even the simplest retirement business needs to be correctly registered. Taking a few smart steps now helps you stay compliant, avoid fines, and build credibility from day one.

Don’t worry—you don’t need a lawyer to get started. Most retirees can register and license their business with just a few online forms and a small fee.

What You Might Need to Register

Depending on your location and structure, here are a few basics to check off:

- State Registration – Required if you're forming an LLC or S-Corp. You’ll file through your Secretary of State’s website.

- DBA (Doing Business As) – Needed if you're using a business name different from your personal name (e.g., “Blowing Rock Woodcraft” instead of “John Smith”).

- Home-Based Business Zoning – Some counties and HOAs have rules about running a business from your home, especially with traffic or deliveries.

💡 Tip: Even if you’re a sole proprietor, a DBA can help you open a business bank account and present professionally.

Industry-Specific Licenses

Some types of businesses have additional licensing requirements, which vary by state and industry. It’s smart to double-check before launching.

Common examples:

- Food – Cottage food laws often require registration, safety certification, and labeling.

- Childcare or education – May need background checks or facility licenses.

- Real estate, massage therapy, or cosmetology – State boards regulate these.

- Home repair or handyman work – Often requires local licensing or bonding.

📍 Where to check:

Start with your State's Department of Business or Licensing, then check your city or county government websites for local rules.

Where and How to File

You can register your business online in most states within 30–60 minutes. Here’s how to handle it step by step:

- Go to your State’s Secretary of State website

- Search your business name to ensure it’s available

- File your LLC or DBA (fees typically $25–$150)

- Apply for a basic business license through your city/county portal if needed

🛠️ DIY or Use a Service?

- DIY – Great for low-cost, straightforward registration (most retirees can handle this)

- LegalZoom, Incfile, ZenBusiness – Helpful if you want a done-for-you service and reminders for renewals or annual filings

✅ Keep a folder—digital or physical—for all your business paperwork, license confirmations, and renewal dates. It’ll save you time and stress later.

Tax Responsibilities for Retiree Business Owners

Starting a business in retirement opens the door to new tax obligations and some valuable tax benefits.

Whether you’re making a few hundred dollars a month or building a full-time second act, understanding your basic tax responsibilities will help you avoid surprises and take advantage of the deductions available.

Let’s break it down in plain English.

Key Concepts to Understand:

Self-Employment Taxes

The IRS considers you self-employed if you're earning money as a freelancer, coach, maker, or consultant. That means you're responsible for paying the employer and employee portion of Social Security and Medicare—about 15.3% combined.

📌 Tip: Set aside 25–30% of your business income in a separate savings account to cover federal and state taxes, including self-employment.

Estimated Quarterly Taxes

If you expect to owe more than $1,000 in taxes for the year, the IRS wants you to pay estimated taxes four times a year (April, June, September, January).

You can use IRS Form 1040-ES or pay online.

Standard Deductions Retirees Overlook:

- Home office (if it's used regularly and exclusively for your business)

- Mileage and car expenses for local travel to events or clients

- Business supplies (paper, software, phone apps)

- Website costs, subscriptions, and education tools

💡 Bonus: These deductions help reduce your taxable business income, which may help you keep more of your retirement benefits intact.

Tools to Make It Easier

You don’t need to become a bookkeeper—you just need a system.

Beginner-Friendly Accounting Tools:

- Wave – Free, simple tool for tracking income and expenses

- QuickBooks Simple Start – Great for generating tax-ready reports

- Google Sheets – Fine for a very small business if you stay organized

When to Hire a Pro:

- If you're earning over $30,000/year

- If you’re collecting Social Security or taking RMDs

- If your business has employees, contractors, or multiple revenue streams

- If you just want peace of mind

🧾 A CPA or retirement-savvy tax preparer can help you minimize tax liability, stay compliant, and even plan smarter withdrawals from retirement accounts alongside business income.

How Business Income Impacts Social Security and Medicare

Starting a business in retirement can bring freedom and purpose. Still, it may also affect your Social Security and Medicare benefits, especially if you’re under full retirement age or earning more than expected.

Understanding how your business income interacts with these programs can help you make smart decisions and avoid surprises at tax time.

Social Security Earnings Limit Rules

If you’re receiving Social Security benefits before your full retirement age (FRA) and you’re still earning income through your business, you may be subject to an earnings limit.

In 2025, the annual earnings limit is $22,320 (adjusts yearly). If you earn more than that from your business:

- Social Security withholds $1 for every $2 you earn above the limit

- In the year you reach FRA, the limit rises to $59,520, and only $1 for every $3 is withheld

- Once you reach FRA, the limit disappears completely—you can earn as much as you want without reducing your benefits

Example:

You're 64, collecting Social Security, and earning $30,000 from a part-time consulting business. That’s $7,680 over the limit. The SSA will withhold roughly $3,840 from your benefits that year.

💡 The withheld benefits aren’t lost—they're credited back later, increasing your monthly benefit after reaching full retirement age.

Medicare & Health Insurance Considerations

Business income can also affect your Medicare costs, especially if it pushes you into a higher income bracket.

Key Points:

- Medicare Part B and Part D premiums are based on your modified adjusted gross income (MAGI) from two years ago

- If your business income causes your MAGI to exceed certain thresholds, you may pay an Income-Related Monthly Adjustment Amount (IRMAA)—a surcharge on your premiums

Can You Deduct Medicare Premiums?

Yes—if you're self-employed and not covered by an employer plan, you may deduct Medicare Part B, Part D, and Medicare Supplement (Medigap) premiums as an above-the-line tax deduction.

What If You're Not Yet Medicare-Eligible?

If you're between 60 and 64 and starting a business, you must secure health insurance until Medicare kicks in. Options include:

- Healthcare.gov (Affordable Care Act marketplace)

- Spouse’s plan

- Short-term or high-deductible plans (not ideal for most retirees)

💬 Pro Tip: Keep your CPA in the loop so they can help you manage income thresholds and time your Social Security start date or business draws wisely.

Protecting Your Retirement Assets and Reducing Risk

You’ve spent decades building a retirement nest egg. The last thing you want is for a business misstep to put that at risk.

The good news is that with a few smart protections, you can safeguard your personal finances and operate with peace of mind.

Asset Protection Basics

When an LLC Adds Peace of Mind

An LLC (Limited Liability Company) isn’t just about taxes—it also creates a legal separation between you and your business. Your personal savings, home, and retirement accounts are generally protected if something goes wrong (like a lawsuit or contract dispute).

Business Insurance: What You Might Need

- General liability – Covers accidents, property damage, or legal claims

- Professional liability (E&O) – Protects you if a client claims your advice caused harm (great for consultants/coaches)

- Product liability – If you sell goods, especially food or handmade items

- Home-based business policy rider – Adds coverage to your existing homeowner’s policy

📌 Call your insurance agent—they can often bundle basic protection cheaply.

Keep Personal and Business Finances Separate

Open a business bank account and use it exclusively for income and expenses. This not only simplifies taxes, but it also strengthens your liability protection.

Estate & Succession Planning Considerations

Should Your Business Be in Your Will or Trust?

If you’ve built something valuable—even a steady side hustle—you may want to include it in your estate plan. Talk with your attorney about adding your business to a living trust or will, especially if your spouse or children might take over.

What Happens if You Stop Working Suddenly?

Illness, injury, or family needs could pause your business. A short written "if something happens" plan—even one page—can help someone step in or wind things down gracefully.

💡 Think of this as protecting your legacy, not complicating it.

Final Thoughts: Get Set Up Right—Then Focus on Growth

You don’t need to become a lawyer or accountant to run a successful second-act business. You need a solid foundation, clear boundaries, and a willingness to ask for help.

Here’s a Recap of Smart Setup Moves:

- Choose a business structure that fits your goals and risk level

- Register your business and check for any local licenses

- Understand how business income affects Social Security and Medicare

- Plan for self-employment taxes and set up a simple system

- Protect yourself with the right insurance and contracts

- Consider how your business fits into your estate plan

🧾 And most of all: Don’t let legal and tax questions delay your dream. Done is better than perfect.

When in doubt, lean on a trusted CPA, attorney, or resource like the Retirepreneur community. You’re not in this alone; taking action, even imperfectly, builds confidence.

You’ve already done the hard part—this next chapter is about building something meaningful, protected, and yours.

✅ Frequently Asked Questions

Do I need to register my business if I’m just freelancing in retirement?

Yes, even part-time freelance work usually requires registering your business. A sole proprietorship is the simplest option, but forming an LLC can offer added liability protection. Requirements vary by state.

Will starting a business affect my Social Security benefits?

If you haven’t reached full retirement age, business income may reduce your Social Security benefits temporarily. Once you reach full retirement age, there’s no income limit. Always check with a financial advisor or the SSA.

What business structure is best for retirees?

For many retirees, an LLC offers a good balance of simplicity, liability protection, and tax flexibility. However, sole proprietorships work well for very low-risk businesses. S-Corps may benefit higher-income earners.

Do I need to pay quarterly taxes as a retiree business owner?

Yes. If you expect to owe more than $1,000 in self-employment tax, the IRS requires estimated quarterly payments. You can use IRS Form 1040-ES to calculate and submit payments.

People Also Ask: What legal steps should I take to start a small business after retirement?

You should choose a business structure, register your business name, get an EIN, and apply for any necessary licenses or permits. Don’t forget to open a separate business bank account and consider business insurance.